unfiled tax returns and stimulus check

If you havent already done so sign in to your TurboTax account and select the Take me to my return button. If your income increased in 2021 you may be asked to return some or all of the stimulus funds.

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns

If however you filed your 2021 tax return and reported 0 for your recovery rebate credit and you do want to claim more stimulus money you will need to file an amended return using IRS Form 1040 X.

. You could have a backlog of unfiled tax returns on queue which youll need to do something about. In the eyes of the IRS non-filers of taxes is a serious offense. However you may need to jump through a few hoops first.

Theres been a lot of confusion about how people who dont file tax returns will get. Covid slows down tax refunds at IRS. In the coming week or so the IRS will first look at your 2019 return and if the 2019 is not filed then the IRS will look at your 2018 return.

As future Coronavirus Stimulus money becomes available if you. After the expiration of the three-year period the refund statute prevents the issuance of a refund check and the application of any credits including overpayments of estimated or withholding taxes to other tax years. What to know when you file your 2020 tax return.

But the amount could be a little underwhelming. If you didnt get any payments or got less than the full amounts you may qualify for the credit even if you dont normally file taxes. For most of us filing our 2018 and 2019 returns is a good idea to see if we are eligible for a stimulus check.

15 hours agoUSA finance taxes and payments live updates. Theres still time to claim a third stimulus payment worth up to 1400 per person. Unfiled Tax Returns Impact Stimulus Check Qualifications.

An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. Perks of Filing Unfiled Tax Returns at MyExpatTaxes. 2753 monthly check income tax deadline 2022 gas stimulus check Social Security.

2 days agoStimulus checks are coming soon for one state. If you have not filed a 2018 or 2019 Federal tax return you will not receive a stimulus check. Stimulus Checks are Impacted by Unfiled Tax Returns.

To get the 1200 Stimulus Check single 2400 married couple and 500 per child your 2018 or 2019 tax return will have to be filed UNLESS your only income is Social SecurityDisabilitySSI or at poverty level 12000 or less in which you will get the 1200 check without filing a return. The 2020 Stimulus Check and Unfiled Tax Returns. With the IRS processing not only tax returns but also the stimulus payments the newest round could cause a further backlog when it comes to processing tax returns that have been filed WDAF a.

To delete all your tax information from TurboTax follow these steps. How do you get a stimulus check if you didnt file taxes. The IRS launched a new tool for people to register for their stimulus checks on April 10 2020.

You can still get a stimulus check even with unfiled tax returns. You create BIG tax problems when you are one of the many IRS non-filers and have unfiled or delinquent tax returns dont submit your income tax returns with the IRS. Here at MyExpatTaxes we have a dedicated package especially for you.

We can help you file quickly for you to receive the Stimulus check as soon as possible. Stimulus checks and your taxes. If you are legally required to file taxes but havent for the past few years youll need to file at least your 2018 tax return.

April 12th 2022 1814 EDT. If you didnt get the full Economic Impact Payment you may be eligible to claim the Recovery Rebate Credit. Due to the government lockdown of the IRS during the IRS pandemics winter months both in 2020 and 2021 the IRS has had a difficult time catching up with the Tax Returns that have been filed and at the same time they are trying to overhaul the oldest computer system in the entire US.

Unfiled tax returns will also prevent the individual or business. 10 hours agoAny stimulus funds paid out in 2021 were based on the last tax return you filed presumably 2020. On the welcome back screen in the left-side menu select Tax Tools and then Clear Start Over select the menu icon in the upper-left corner if you dont see this menu.

Additional consequences are now felt in the post-Coronavirus world of unfiled tax returns for individuals and businesses. Illinois is pushing ahead with rumored plans to issue statewide stimulus checks in its latest budgetAt the start of the month Illinois state Senate Democrats proposed 18 billion in tax cuts that would include stimulus checks for nearly all residents of the state. If you have not filed your tax returns for 2018 and 2019 you will not receive a Coronavirus stimulus check.

This is one of the most affordable options for getting back on track with your US expat. The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further enforce the law. As an American expat or Green Card Holder living abroad if you forgot or didnt know you had to file US tax returns and the FBAR annually theres a tax amnesty solution for you.

To get the checks your income as a single person will have to be less. The Streamlined Procedure allows you to avoid tax penalties and fees and puts you back on. Youll need to file your taxes ASAP to be eligible for a check.

Eligible taxpayers who didnt receive the payment or may be. IRS increasing focus on taxpayers who have not filed tax return. May cause you to have your stimulus check to be delayed until non filed taxes are filed.

March 27 2020 Back Tax Relief Stimulus Check Unfiled Returns. Youll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit. In addition the IRS is increasing the use of data analytics research and new compliance strategies including.

Whether you get a stimulus check or not relies heavily on your taxes even if you dont file at all. This is the case if. There are even more consequences for individuals and business owners who fail file in the post-Coronavirus world of Coronavirus Stimulus checks.

All the forms you need are included in one flat fee of 696 Euro.

1 5 Billion In Refunds Attached To Unfiled 2018 Tax Returns Available Until April 18 Gobankingrates

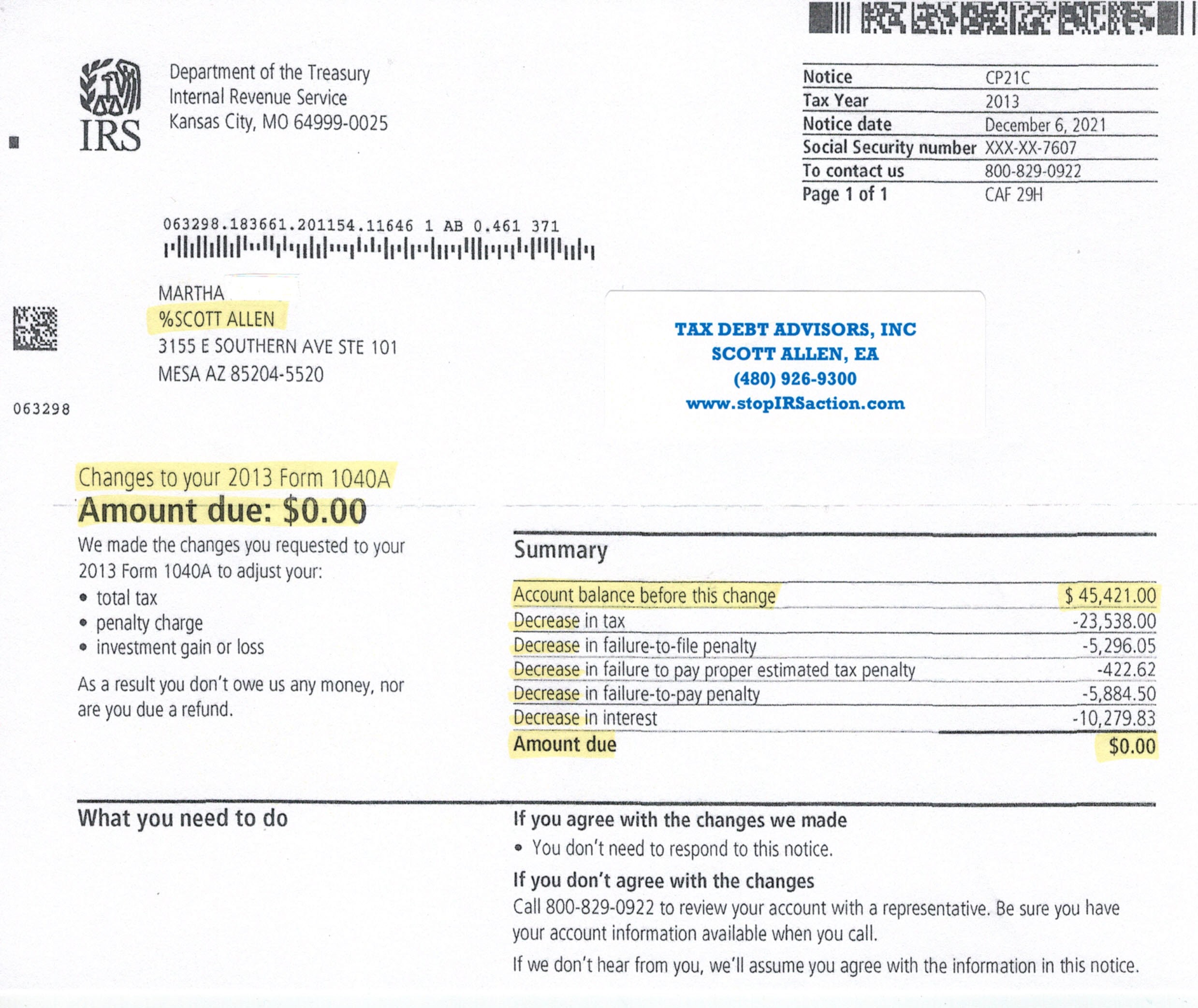

Phoenix Az Irs Tax Attorney Tax Debt Advisors

How To Fill Out A Fafsa Without A Tax Return H R Block

Irs Tries To Reassure Pandemic Panicked Taxpayers

Unfiled Tax Returns Back Taxes Jacksonville Tax Attorney

Irs The Notices Will Stop But You Still Need To Pay Fingerlakes1 Com

Have Unfiled Tax Returns As A Us Expat Here S What To Do About It

Irs Mind Staff Author At Irs Mind

Unfiled Past Due Tax Returns Faqs Irs Mind

What To Do If You Owe Money To The Irs Borshoff Consulting

Unfiledtaxreturns Twitter Search Twitter

Faqs On Tax Returns And The Coronavirus

Irs Notice Cp2566 We Still Have Not Received Your Form 1040 H R Block

Is It Illegal Not To File Your Taxes If So Why Taxrise Com

Unfiledtaxreturns Twitter Search Twitter

The Penalty Will Be Waived This Year For Any Taxpayer Who Paid At Least 80 Percent Of Their Total Tax Liability Du Estimated Tax Payments Tax Payment Nanny Tax